I was interviewed by AlleyWire. They’re good; I actually sound coherent. 🙂

Avoid Articulate Bullshit

As an entrepreneur and investor in seed-stage start-ups, I often get asked by founders: “What do you look for in an investment?” “What are the criteria you use to evaluate start-ups?” And to be honest the answers I give mostly feel inadequate. If it’s a quick conversational answer, I’ll say something like : “The most […]

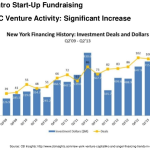

Show Me the $$$$!…Session 5: VC’s: What are they investing in? Why?

Show Me the Money: What are VC's investing in and why? from Thomas Wisniewski

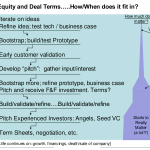

Show Me the $$$$!…Session 4: Insiders guide to Debt vs. Equity

Insiders guide to Debt vs. Equity, and Key Deal Terms

“Show Me the $$$$!”…Session 3: Angels!

Insiders guide to Angels and Angel Investment

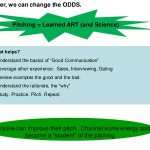

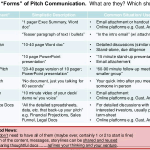

“Show Me the $$$$!”…Session 2: Pitching

Learn from VC’s, Angels and Entrepreneurs: What do INVESTORS love (and Hate!) to see in a Pitch?

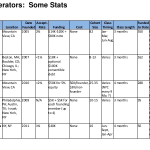

Session I – Seed Accelerators: “Start-up Scourge or Super-charger?”

Session I – Seed Accelerators: “Start-up Scourge or Super-charger?” Monday July 29, 2013 General Assembly Seminar Part of the “Show me the $$$$!” GA event series: Insider perspective on fundraising and entrepreneurship

The Seed Stage Pitch: Mastering the Art and the Science

Insights on successful pitching from an active angel investor and fellow entrepreneur General Assembly Seminar Tom Wisniewski RosePaul Investments Monday, April 15th, 2013

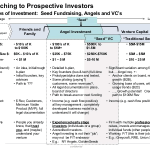

Seed Fundraising for Tech Entrepreneurs: Mastering the Art and the Science

Insights on successful fundraising from an active angel investor and fellow entrepreneur ERA Class and Discussion Tom Wisniewski RosePaul Investments Monday, March 25, 2013

Seed Fundraising for Tech Entrepreneurs

A deck I presented at General Assembly in NYC seminar on best practices in fundraising for seed-stage tech start-ups. Target Audience: Tech-Startup Entrepreneurs